Market Cycle Trends: Mastering Higher Highs and Lower Lows Through Geocosmic Indicators

August 10, 2023

Introduction

The language of market cycle trends often uses the phrases “higher highs and lower lows.” To those unfamiliar with the world of finance, these terms might seem strange. In essence, these terms refer to the peak and trough points of a particular market cycle. In this context, we must ask: “what is a higher low?” A higher low refers to the point in a market cycle where the price dips but does not go as low as the previous low point. In other words, the low is higher than the preceding one, hence “higher low.” This concept is instrumental in understanding the intricate patterns that define market behaviors and trends.

Understanding Market Cycle Trends

The rhythmic dance of “higher high and lower low” patterns defines market cycle trends. These terms represent crucial turning points in the markets: a “higher high” is a peak point that is higher than the preceding peak, while a “lower low” refers to a trough that is lower than the previous trough. Recognizing these patterns can provide invaluable insight into the direction a market is likely to take. For example, a series of “higher highs and higher lows” suggests an upward, or bullish, trend.

The principles guiding these patterns, known as “Trend Analysis,” have been key to the success of MMA Cycles. Incorporated after the groundbreaking work of Raymond Merriman, the company recognized the importance of these patterns across various market cycles, including the Economic Cycle, The Business Cycle, The Credit Cycle, and The Property Cycle.

Forecast 2023 Scorecard- As of August 1, 2023

August 04, 2023

FORECAST 2023 SCORECARD AS OF JULY 24, 2023

Every year gets better and better with our forecasts. Although 2023 is not yet over, several forecasts made in the Forecast 2023 Book have already unfolded. We will list a few of the forecasts below as of July 24. Keep in mind these forecasts were written in October-November 2022, and published December 2022, well before 2023 got underway. As far as market sectors go, 2023 was an awesome year for forecasting, with the exception of Gold, which bottomed as we were writing the 2023 book. Particularly awesome were the Stock, currencies, and Bitcoin markets. Read below.

ECONOMIC AND MARKET FORECASTS FOR 2023 (written August 1-November 20, 2022)

The U.S. Stock Market and DJIA: “Our focus will be on a 3-year cycle low due March 2023 +/- 6 months. It may have already happened on October 13, 2022, when prices fell to 28,660. The price target for this low is 27,582 +/- 2211 At the same time, we do not expect the DJIA to rally more than a range of 2% from the all-time high of 36,952 of January 2022, and maybe not even that high. Traders may look to buy on declines to 27,500-29,000 in 2022 with stop-losses based on one’s risk tolerance and sell if the DJIA shows resistance between 35,500-37,500, especially if it happens near a geocosmic critical reversal date listed below.” As of August 7, the low of October 13, 2022 is holding and the high is now 35,679, in our upside price target range given. Six of the eight (and maybe 7 of the 9) critical reversal dates given have been within one trading days of a major reversal so far

Forecast FAQs

July 31, 2023

Our Annual Forecast Pre-Order Event will run from August 8- October 31 2023. Our Forecast Books will be mailed out around Late- December 2023. We cannot guarantee domestic or international orders will be received by the buyer before Christmas or Hanukkah. We created a list below of our most common FAQs to help this Forecast season. We are always available to answer any of your Forecast questions via email at CustomerService@mmacycles.com.

Forecast Club Levels

July 30, 2023

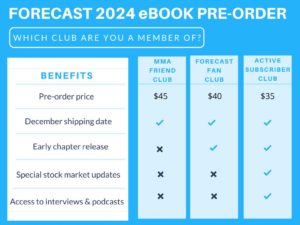

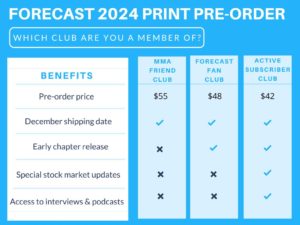

Every August MMA runs our annual Forecast Pre-Order Event. If this is your first Forecast season with us, welcome! If you have been ordering the Forecast Book for years, welcome back and thank you for your continued support. This is our favorite, and most busy, time of year.

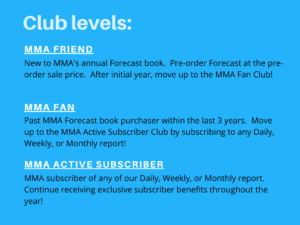

Everyone is invited to be part of our special event where you can pre-order the Forecast 2024 Book at a discounted price through the end of October AND save 10% on MMA subscription reports. If you have ordered Forecast in the past three years, then you are part of our Forecast Fan Club and will be sent a coupon code on August 8th to save an additional $7 on Forecast 2024 Print or Bundle and $5 on Forecast 2024 eBook. If you are an active subscriber, then you are part of our Active Subscriber Club and you will be sent a coupon code on August 8th to save an additional $13 on Forecast 2024 Print or Bundle and $10 on Forecast 2024 eBook. Being a member of the MMA Forecast Fan Club (past purchaser of Forecast Book) or a member of the MMA Active Subscriber Club (current subscriber to paid reports) have additional benefits listed below.

To learn more about our annual event, please check out our Annual Forecast Pre-Order Event Page and Forecast FAQ Page which hosts a wealth of information. You may also send us email to CustomerService@mmacycles.com with any questions you have.

Visit our Forecast 2024 Page on August 8th to pre-order Forecast 2024.

MMTA3 Frequently Asked Questions

January 30, 2023

Thank you for your interest in MMA’s Market Timing Academy, MMTA3 beginning in March 2023.

We have created a list below of our most common questions we have been asked by prospective students of MMTA3. We are always available to answer any of your questions via email at MMTA@mmacycles.com. You may also connect with program director, Gianni Di Poce, Gianni@mmacycles.com, if you wish to learn more about MMTA3.

We have a MMTA3 Program Schedule available to review where we explain the topics covered throughout the program. We also created a MMTA3 Common Questions document where we address time, cost, and value of MMTA3.

We will continue to update this list of Frequently Asked Questions as we approach out March start date of MMTA3.

Watch MMTA Q&A Webinar with Gianni and Ray hosted in February 2023 to learn more about the upcoming program.

If you have not already done so, please hear what some of our MMTA2 students had to say about their experience in 2021-2022. You may also hear what our MMTA1 graduates had to say about the original MMTA program offered in 2013-2014. Watch this interview between Ray and Gianni from 2020 where they discuss what information will be covered in the MMTA program.

We look forward to having you join us in March for MMTA3!

Forecast 2022 Scorecard- As of July 25, 2022

October 23, 2022

Every year gets better and better with our forecasts. Although 2022 is not yet over, several forecasts made in the 2022 book have already unfolded. We will list a few of the forecasts below as of July 25. Keep in mind these forecasts were written in October-November 2021, and published December 2021, well before 2022 got underway.

ECONOMIC AND MARKET FORECASTS FOR 2022 (made prior to December 1, 2021) The U.S. Stock Market and DJIA: “…In today’s terms, this (Jupiter/Saturn cycle phase) would imply a peak is happening now, as we enter 2022, and a bottom in 2022-2023… However, our bias is that the U.S. stock market will make a double-digit decline from its all-time high into a 22.5- or 24- month cycle low that is due by July 2022.. We expect the end of the cycle will exhibit the steepest decline (since March 2020), which so far has been 10.46% in October 2020…The ideal decline in the DJIA would be 10-20%.” – Result: The DJIA made its all-time of 36,952 on January 5, 2022. It’s low as of this writing has been on June 17, 2022 at 29,653, which is a decline of 19.75%.

Forecast 2021 Scorecard- As of July 21, 2021

August 01, 2021

Every year gets better and better with our forecasts. Although 2021 is not yet over, several forecasts made in the 2021 book have already unfolded. We will list a few of the forecasts below as of July 21. Keep in mind these forecasts were written in October-November 2020, and published December 2020, well before 2021 got underway.

ECONOMIC AND MARKET FORECASTS FOR 2021 (made prior to December 1, 2020)The U.S. Stock Market and DJIA: “… There are reasons to support a continuation of the bull market off the lows of March 2020… The next sign of potential trouble for the bull market in the U.S. stock market will happen if and when the DJIA takes out support at 25,000–26,000. Until then, our advice for investors is to stay with bullish strategies. That is, buy corrective declines (even if sharp) into the 50-week and 16.5-month cycle lows due in 2021. But as long as the DJIA does not fall below 25,000–26,000, it is probably a buying opportunity.” The DJIA never traded that low. Instead, it continued to rally and as of this writing, it has made a new all-time high 35,631 as of August 16, just four days before the August 20 critical reversal date listed in the book. The S&P and NASDAQ have continued making new all-time highs on September 3 and 7 respective, right on the September 3-6 critical reversal date listed.

Forecast 2020 Scorecard- As of September 21, 2020

July 28, 2020

Although 2020 is not yet over, several forecasts made in the 2020 book have already unfolded. We will list a few of the forecasts below as of September 21, 2020 and the list will be updated Events and Articles. Keep in mind these forecasts were written in October-November 2019, and published December 1, 2019, well before 2020 got underway.

ECONOMIC AND MARKET FORECASTS FOR 2020 (made prior to December 1, 2019)

The U.S. Stock Market and DJIA: “… the crest of this first 15.5-month cycle tops out before April, then declines into a low before October, then has another rally that tests or makes a new all-tike high in the second phase. As far as an upside target, two others at 29,663 +/- 938 and 33,293 +/- 2115 are developing. Additionally, with Jupiter in Capricorn, along with Saturn and Pluto, the path to higher highs is likely to be difficult than experienced in 2019 when Jupiter was in Sagittarius… The Jupiter/Saturn conjunction of December 21, 2020 argues for the high to be within five months of December 2020.” The all-time in the DJIA occurred on February 12, 2020 at 29,568. It then dropped 38% into its low as of this writing on March 23. U.S. stocks then embarked upon another major rally, and as of this writing, the NASDAQ and S&P have made new all-time highs the first week of September, in an MMA 3—star critical reversal date time band.

Trading with MMA Market Timing Methods: Recordings now available!

February 25, 2020

Trading with MMA Market Timing Methods: Recordings now available

Raymond Merriman will be hosting a three-part course on how to use the MMA Market Timing Methods and subscription reports starting in March. Trading with MMA Market Timing Methods is a three-part course over four weeks. Each two-hour class is designed for traders who want to learn more about trading futures as well as ETFs. The class size is limited to 30 students. All classes will be live and will be recorded so that the video recordings are available to the students for review. Read our interview with Raymond below to learn more about the class and how to sign up now!

Dates: March 11, March 25, April 1

Time: 7-9 pm EST

Instructor: Raymond Merriman

Platform: Hosted via Zoom

Cost: $295

Forecast 2019 Scorecard- As of November 7, 2019

November 07, 2019

Although 2019 is not yet over, several forecasts made in Forecast 2019 have already unfolded. Below are a few of the forecasts as of August 2019, and this list will continue to be updated. Keep in mind, these forecasts were written in October-November 2018, and published December 2018, well before 2019 was underway.

ECONOMIC AND MARKET FORECASTS FOR 2019 (made prior to December 2018)

The U.S. Stock Market and DJIA: “Cycle studies suggest the crest of a 4-year cycle will be completed by October 2019 and probably before the end of July 2019… You can also see from this graph that long-term cycle highs tend to occur when helio Jupiter is in Sagittarius, which is in effect October 6, 2018 through October 19, 2019… Jupiter transiting through Sagittarius is a reason to think that the U.S. stock market could make yet another high, above the all-time high of October 3, 2018. With this study in mind, we will look for the high of October 3, 2018, to be tested, and even taken out in 2019.” The DJIA did make a new all-time high of 27,398 on July 16, above the high of the previous year. After a significant decline into mid-August and early October, the DJIA soared again to new highs in early November. The 2019 Book also mentioned in the conclusion, “Investors are advised to look for a high by July 2019, and possibly extending into 2020, but be cautious, because a severe decline is scheduled to begin with that high and last into 2021-2023.” So, there was a high in July, and now as we enter the last two months of the year and prepare for early 2020, stock indices are making new highs.